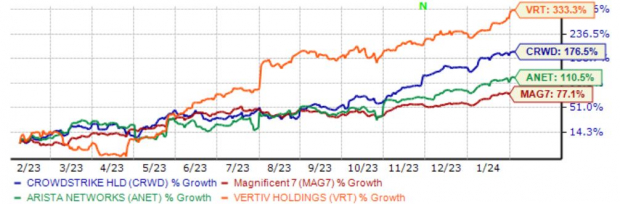

The Magnificent 7 (Apple, Meta Platforms, Alphabet, Microsoft, Tesla, NVIDIA, and Amazon) group has been the dominant story of the market for some time now, performing remarkably and providing stellar gains. They’ve led the market, with recent quarterly results from a few members adding further excitement and extending the positive price action.

Thanks to their dominant market stance, outperforming the group has been nearly impossible. However, that certainly hasn’t been the case for all, including Vertiv VRT, CrowdStrike CRWD, and Arista Networks ANET.

All three stocks have outperformed the Magnificent 7 as a group over the last year, as we can see illustrated below.

Image Source: Zacks Investment Research

In addition, all three sport a favorable Zacks Rank, reflecting upward trending earnings estimate revisions. For those seeking to outperform the market titans, let’s take a closer look at each.

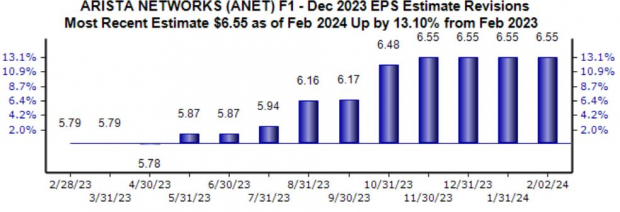

Arista Networks

Arista Networks, a Zacks Rank #1 (Strong Buy), is an industry leader in data-driven, client-to-cloud networking for large data centers, campus, and routing environments. The revisions trend has been particularly bullish for its current fiscal year outlook, up 13% to $6.55 per share over the last year.

Image Source: Zacks Investment Research

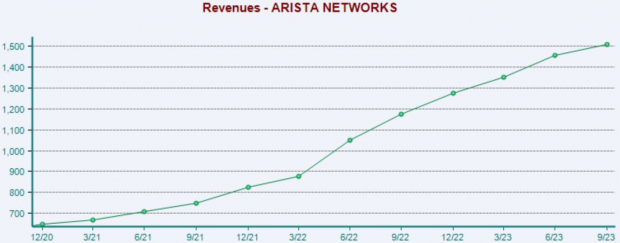

The company’s quarterly consistency can’t be overlooked, exceeding beat both top and bottom line consensus expectations in each of its last ten releases. The company’s top line has enjoyed significant expansion over the last few quarters thanks to customer momentum in both enterprise and cloud/AI sectors.

Image Source: Zacks Investment Research

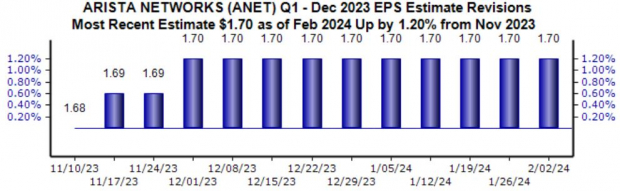

Keep an eye out for the company’s next quarterly release scheduled for February 12th, as current consensus expectations currently suggest 21% earnings growth on 20% higher sales. Analysts have taken their bottom line expectations modestly higher since last November.

Image Source: Zacks Investment Research

CrowdStrike

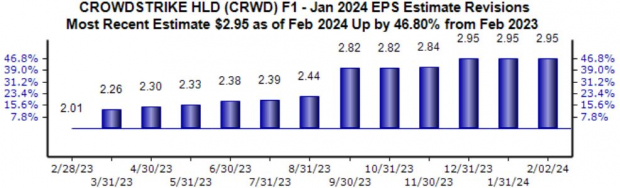

CrowdStrike, a current Zacks Rank #1 (Strong Buy), is a leader in next-generation endpoint protection, threat intelligence, and cyberattack response services. Like ANET, the revisions trend for CrowdStrike’s current fiscal year has been robust, up 46% to $2.95 per share over the last year.

Image Source: Zacks Investment Research

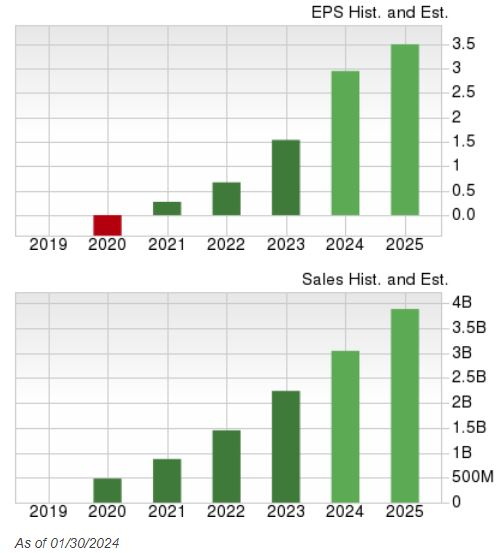

The stock remains a prime consideration for growth investors, currently carrying a Style Score of ‘A’ for Growth. Consensus expectations for its current fiscal year suggest 90% earnings growth paired with a sizable 36% revenue climb.

Image Source: Zacks Investment Research

CrowdStrike’s latest set of quarterly results had shares moving higher post-earnings, with the company delivering record profitability and record free cash flow. Annual recurring revenue also showed considerable growth, improving 35% year-over-year.

Shares have jumped higher post-earnings in back-to-back releases.

Image Source: Zacks Investment Research

Vertiv

Vertiv, a current Zacks Rank #2 (Buy), is a global leader in designing, building, and servicing critical infrastructure that enables vital applications for data centers. The company is the only pure-play data center infrastructure provider able to deliver across the entire spectrum of thermal and power technologies.

Shares aren’t valuation stretched given the company’s forecasted growth, with shares currently trading at a 27.1X forward earnings multiple (F1). Consensus expectations for its current year allude to a 220% pop in earnings on 21% higher sales.

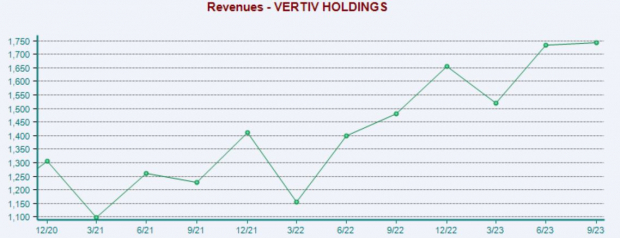

The company’s top line expansion has already been impressive, posting double-digit percentage year-over-year revenue growth rates in six consecutive quarterly releases.

Image Source: Zacks Investment Research

Vertiv will deliver its next set of quarterly results on February 21st. Current consensus expectations suggest 90% earnings growth and 14% expansion across the top line. Shares have moved higher post-earnings in three consecutive releases.

Image Source: Zacks Investment Research

Bottom Line

While most market headlines are centered around the Magnificent 7 group, investors may be surprised to learn that there have been other stocks delivering even stronger gains.

All three stocks above - Vertiv VRT, CrowdStrike CRWD, and Arista Networks ANET - have precisely done that, delivering ‘Mag 7-beating’ gains over the last year.

In addition, all three sport favorable Zacks Ranks, with upwards trending earnings estimate revisions helping drive the moves.

*7 Best Stocks for the Next 30 Days

*Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

*Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>