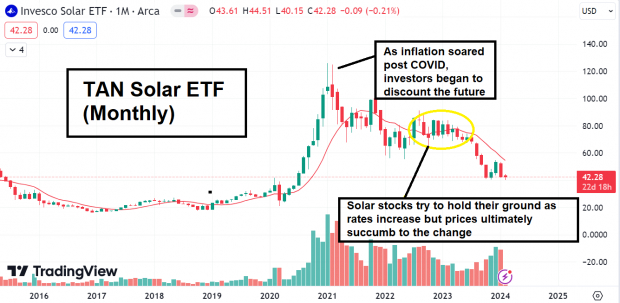

Interest Rates are a Headwind for Solar Stocks

Higher interest rates can pose challenges for the solar industry due to increased financing costs. Solar projects require substantial upfront investments, and when interest rates rise, borrowing becomes more expensive. The elevated cost of capital can diminish the profitability of solar ventures and thus slow business in the industry to a standstill. In early 2022, the U.S. Federal Reserve did a complete 360-degree turn from its "dovish" (low-interest rate) stance and became "hawkish," raising interest rates at a clip not seen in years to combat 40-year highs in inflation. Even before rates jumped, investors began to discount cuts in the future as stubborn inflation loomed. As a result, the Invesco Solar ETF (TAN), a proxy for the solar industry,cratered from a high of ~$126 in January 2021 to a low of $40 this week.

Image Source: TradingView

With the average solar stock cut in half over the past twelve months, is it time to revisit solar stocks?

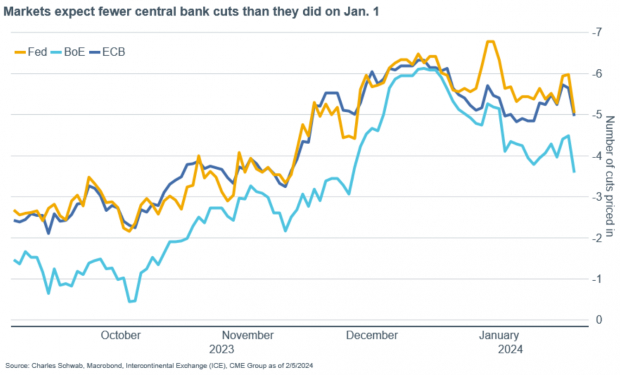

Investors should first look at interest rate odds moving forward to help answer the question. Presently, markets expect fewer central bank cuts than they did on January 1st. However, the market still expects multiple cuts later in 2024.

Image Source: Charles Schwab, Interncontinental Exchange, CME Group

"Skate to where the puck is going to be, not where it has been."

It’s Deeper than Rates: Markets are Forward-Looking

While many investors will look at the relationship between rates and solar stocks and move on, some nuance is involved in analyzing the industry. Recall that solar stocks began to sell off hard in anticipation of rate cuts in January 2021, long before the Federal Open Market Committee enacted what would be eight interest rate increases. Though rate cuts may not occur as early as investors want, solar stocks are likely to begin discounting the future as they did before.

Valuations are Becoming Attractive

NextEra Energy (NEE), the largest solar company in the United States by revenue, is trading at a Price-to-Earnings (P/E) multiple of 17.6x - the "cheapest level in eight years.

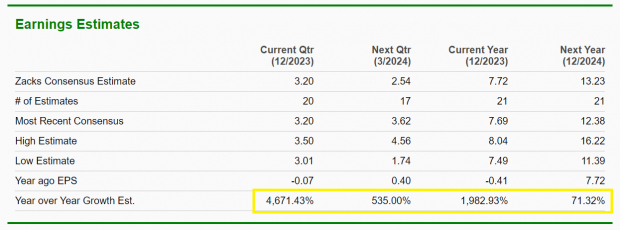

Image Source: Zacks Investment Research

Analysts See Solar Juggernauts Swinging to a Profit

Meanwhile, Wall Street analysts are warming up to solar giants likeFirst Solar (FSLR) again.Over the next year, Zacks Consensus Estimates suggest that FSLR will swing to a profit from a string of losses last year.

Image Source: Zacks Investment Research

Who is the Market Leader?

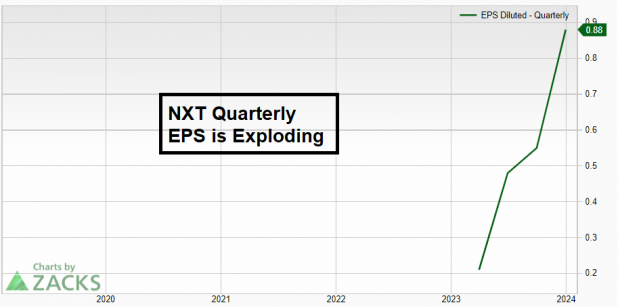

Though the entire solar industry looks ripe for a rebound, one solar-related stock stands far above the rest: Nextracker Inc. (NXT). Nextracker specializes in providing advanced technologies for solar power systems. NXT designs and manufactures solar tracking system devices that tilt and turn solar panels to follow the sun’s path throughout the day.

A Solution to the Solar Efficiency Problem?

Though worldwide solar usage has increased dramatically in recent years, efficiency remains a significant obstacle for the space. Now, solar companies can use Nextracker’s technology to help solar panels stay aligned with the sun for more extended periods, optimizing energy production and making solar power more efficient and cost-effective.

"During a Gold Rush, Sell Shovels"

The best businesses are often parallel businesses to a growing cyclical trend. For example, Nvidia (NVDA), which supplies high-performance chips, has taken advantage of the AI frenzy and has increased its earnings and stock price more than most AI pure plays. The same is occurring with NXT. While most solar companies are seeing stagnant earnings, NXT’s unique product energized quarterly EPS by a robust 231% year-over-year.

Image Source: Zacks Investment Research

Bottom Line

Higher interest rates cause challenges to the solar industry due to increased financing costs. Solar stocks have plummeted as a result. However, despite the industry downturn, potential opportunities exist. Nextracker Inc, stands above the rest.

*Zacks Names "Single Best Pick to Double"

*From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

*It’s credited with a "watershed medical breakthrough" and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

*It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up