Catalent’s CTLT shares rose 7.2% so far this week. The company’s share price surged following the announcement of its acquisition by Novo Holdings, the parent company of Novo Nordisk NVO.

Catalent entered into a merger agreement with Novo Nordisk’s parent company on Feb 5. Per the agreement, NVO’s parent company will acquire all outstanding shares of Catalent for $63.50 per share in cash. The deal values Catalent at $16.5 billion on an enterprise value basis.

The offered price for each share of CTLT represents a premium of 16.5% to the closing price of its common stock as of Feb 2. The merger is expected to close toward the end of 2024, following shareholders’ and regulatory approvals.

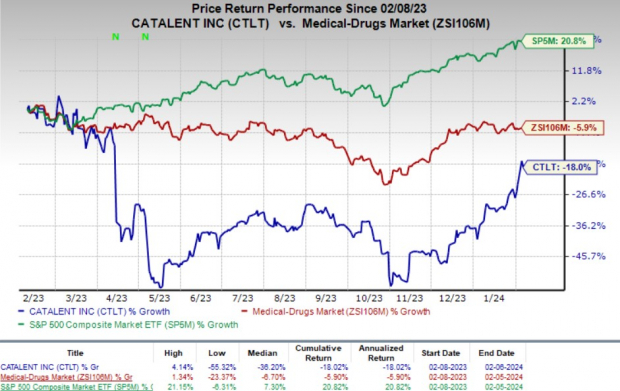

Over the past year, this currently Zacks Rank #3 (Hold) stock fell 18% compared with the industry’s 5.9% decline and the S&P 500’s 208% growth.

Image Source: Zacks Investment Research

More on the News

Over the past several years, Catalent has built a comprehensive end-to-end offering of services and capabilities to drive innovation in the healthcare system and improve patient outcomes. These services and capabilities are likely to offer premium development and manufacturing solutions for pharma and biotech customers with a potential accelerated investment by Novo Holdings.

As a part of the deal, Novo Nordisk will acquire three of Catalent’s fill-finish sites from Novo Holdings for $11 billion, which will support the manufacturing capacity at scale and speed for Novo Nordisk’s diabetes and obesity treatments. The acquisition is expected to gradually increase NVO's filling capacity starting 2026.

Novo Nordisk already has a collaboration agreement with Catalent, under which it uses these three sites to support the manufacturing of its treatments. The acquisition of these facilities will complement the ongoing significant investments by Novo Nordisk in active pharmaceutical ingredients facilities, and the sites will provide strategic flexibility to the existing supply network.

What’s Next?

Catalent’s shares are currently trading close to the acquisition price, so its investors may sell them now and invest in other good stocks. The only exception is that they can pay less tax on their capital gains by selling later.

Zacks Rank and Stocks to Consider

Cardinal Health carries a Zacks Rank #3 (Hold) at present.

A couple of better-ranked stocks to consider in the broader medical space are Universal Health Services UHS and Integer Holdings Corporation ITGR.

Universal Health Services, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 4.4% for 2024. UHS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 5.47%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UHS’ shares have risen 11.7% over the past year compared with the industry’s 18.55% decline.

Integer Holdings, presently carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 45% in the past year compared with the industry’s 2% increase.

*Zacks Names "Single Best Pick to Double"

*From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

*It’s credited with a "watershed medical breakthrough" and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

*It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up