Benny Landa’s LUSIX wants to reach a debt settlement with its creditors to stabilize the company after lab-grown diamond prices have fallen 90% on world markets.

Benny Landa’s lab-grown diamonds (LGD) producer LUSIX is expected to request a debt arrangement after it failed to raise money from existing investors led by LVMH (Louis Vuitton Moet Hennessey) Luxury Ventures, as well as Israeli investors More Provident and Pension Funds, Maverick Ventures and Gabi Dishi’s Ragnar Crossover Fund and its partner Alpha Investments. Sources close to Benny Landa say that the war has made it difficult to find investors for the company. LUSIX has debts of $15 million to Bank Leumi, Israel Discount Bank and Amot Investments.

LUSIX wants to reach a debt settlement with its creditors to stabilize the company and give itself breathing space for several weeks until it reaches an agreement with an Israeli international chain of jewelry stores as well as agreements with existing investors on a recovery plan.

LUSIX has raised an estimated $150 million to date include $60 million from serial entrepreneur Benny Landa’s Landa Group, which founded it and $90 million from other major investors led by LVMH. The company has been hit by the drastic fall in prices of lab-grown diamonds on the free market, due to huge investments in it in India, which has made production in Israel unprofitable. Since India flooded the market with lab-grown diamonds, prices have fallen by more than 90%.

Published by Globes, Israel business news - en.globes.co.il - on August 18, 2024.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2024.

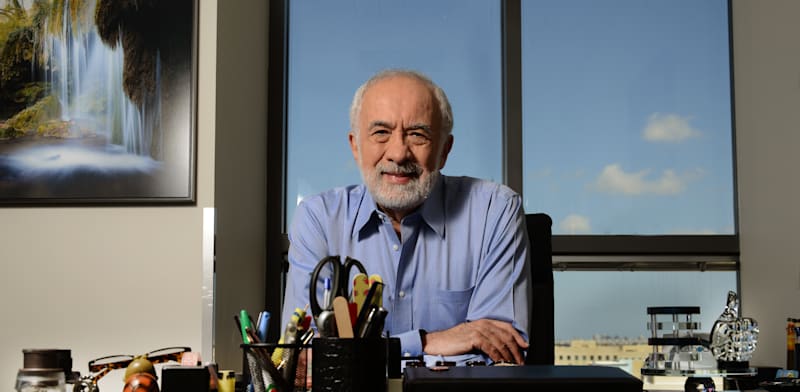

Benny Landa credit: Eyal Izhar